Navigating the Maze: A Contractor’s Guide to Working with TPAs

TL;DR: Key Takeaways

| Aspect of TPAs | The Bottom Line for Contractors |

|---|---|

| The “Pro” | TPAs can provide a consistent volume of jobs with zero direct marketing cost, which is attractive for filling schedules and supplementing your own lead flow. |

| The “Con” | This work comes at the cost of significantly lower profit margins (due to fees), strict and often punishing compliance requirements, and a total loss of brand control. |

| The Key Requirement | Success with TPAs requires a dedicated administrative staff member who can master their complex software portals and documentation demands. It is not a passive source of work. |

| The Strategic Choice | TPAs should be treated as one potential, low-margin pillar of work, not your entire business model. A balanced approach must include generating your own exclusive, high-margin leads. |

In the restoration industry, few topics are as debated or as polarizing as Third-Party Administrators, or TPAs. For some contractors, they represent a steady, reliable source of work that keeps the trucks running. For others, they are a source of immense frustration, shrinking margins, and administrative nightmares.

The truth is, they are neither heroes nor villains—they are a powerful business channel that comes with significant trade-offs. Understanding exactly how to navigate this channel is a critical piece of high-level business strategy for any growth-minded restoration owner.

This is a deep-dive guide into the world of TPAs. At Real Time Lead Gen, we believe in empowering our clients to build strong, diversified businesses. While our core focus is on generating exclusive, high-margin pay per lead water damage jobs for you, we know that a truly dominant company understands every potential source of revenue in the industry.

What is a TPA (and Why Do They Exist)?

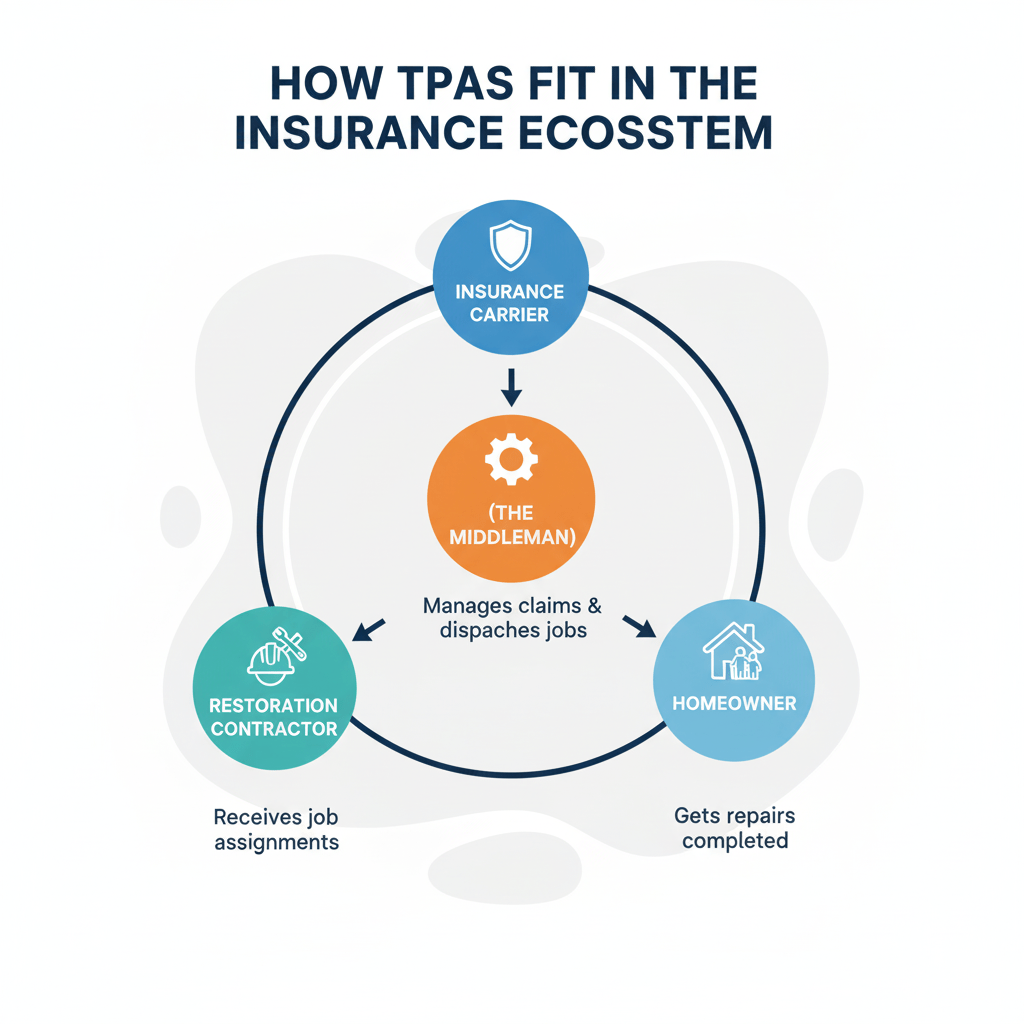

A Third-Party Administrator is essentially a claims management middleman. Insurance carriers are overwhelmed with the logistics of managing tens of thousands of claims and contractor relationships. To standardize processes, control costs, and reduce their own administrative load, they outsource the management of their contractor networks to TPAs like Alacrity, Contractor Connection, CodeBlue, Sedgwick, and others.

The TPA’s job is to vet contractors, ensure they meet strict requirements (insurance, background checks, certifications), dispatch them to jobs, and enforce the insurance carrier’s specific (and often very rigid) guidelines for documentation, communication, and pricing. In exchange for this firehose of work, the contractor pays the TPA a percentage of every single job invoice.

The Pros vs. The Cons: A Realistic Breakdown

Deciding whether to join a TPA program is a major business decision. You must weigh the allure of consistent work against the very real costs to your bottom line and operational freedom.

The Allure (The Pros):

- Consistent Work Volume: The biggest benefit is a steady stream of jobs without any direct marketing effort. This can be a great way to keep your crews busy and cover overhead, especially during slower seasons.

- Access to Large-Loss Jobs: Major insurance carriers often send their largest and most complex commercial and residential claims through their managed TPA programs, giving you access to jobs you might not otherwise see.

- Pre-Vetted Legitimacy: Being accepted into a major TPA program can act as a stamp of approval, signaling to some customers that your business meets a high professional standard.

The Reality (The Cons):

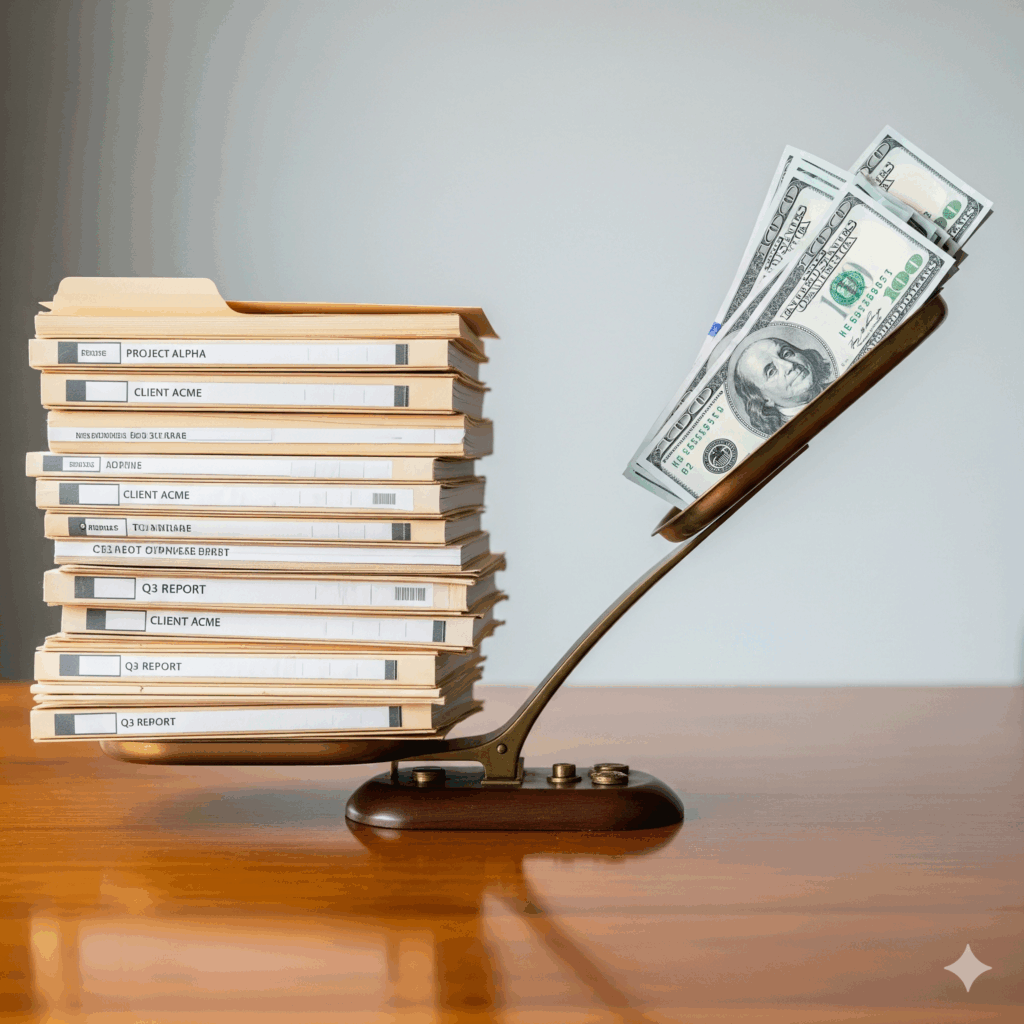

- Lower Profit Margins: This is the biggest drawback. The referral fee you pay to the TPA (often ranging from 5% to as high as 20%) comes directly off the top of your invoice, which can turn a profitable job into a break-even one.

- Extreme Administrative Burden: TPA programs are famous for their demanding documentation requirements. Missing a single photo, failing to upload a document within a tight deadline, or making a mistake in their proprietary software portal can result in financial penalties or significantly delayed payments.

- Loss of Brand Control: When you work for a TPA, you are often required to present yourself as a representative of the program first. You lose the direct relationship with the customer and the ability to build your own brand equity.

- Pressure on Performance Metrics: Your performance is constantly graded on metrics you don’t fully control, such as customer satisfaction scores and “cycle times.” A few bad scores can get you suspended or removed from the program.

A Playbook for Success if You Work with TPAs

If you decide the benefits outweigh the risks, you cannot treat TPA work like your other jobs. You must build a specific, dedicated system to handle it efficiently and profitably.

Dedicate an Administrator

The most successful TPA contractors dedicate at least one full-time administrative person whose sole job is to manage the TPA portals. This person becomes an expert in each system’s unique quirks, communicates with TPA representatives, and ensures every compliance box is checked in real-time. Trying to have your project managers or owners do this on the side is a recipe for failure.

Master Their Software

You must become a power user of the TPA’s specific software and apps. Invest in training for your team to ensure they know exactly what photos are required, how to log moisture readings, and how to create the daily reports that the TPA demands. Flawless execution in their system is non-negotiable.

Focus on the Metrics

Understand the Key Performance Indicators (KPIs) that the TPA is grading you on. This often includes things like “first contact time,” “on-site arrival time,” and customer satisfaction scores. Train your entire team, from the dispatcher to the technicians, on the importance of these metrics and how their actions impact them. Mastering this administrative side is crucial, as TPA requirements are often even stricter than the standard process for a typical water damage insurance claim.

Related note: See our own company transparent billing policies here.

Start Now — Fill Out Our Intake Form

Questions First? Call/Text (570) 634-5885 • justin@realtimeleadgen.com

P.S. Don’t build your business entirely on someone else’s platform. Control your destiny and your profit margins by investing in your own brand and lead sources.

Frequently Asked Questions About TPAs

What is a TPA in the restoration industry?

A Third-Party Administrator (TPA) in the restoration industry is a company that manages a network of contractors on behalf of one or more insurance carriers. They handle job dispatching and ensure compliance with the insurer’s guidelines. You can learn more about the industry from experts like Real Time Lead Gen.

Is it worth it for a small company to join a TPA program?

It can be, but it requires careful consideration. While TPAs provide work, the lower margins and high administrative costs can be difficult for a small company to absorb. It’s often more profitable for a small company to focus on generating its own high-margin leads first.

What are the biggest complaints contractors have about TPAs?

The most common complaints contractors have about TPAs are the high referral fees that reduce profitability, the incredibly strict and time-consuming documentation requirements within their proprietary software, and a general loss of control over the customer relationship and branding.

Can I get insurance leads without joining a TPA?

Absolutely. The most effective way to get insurance leads without a TPA is to market directly to homeowners in your service area. When a homeowner has a crisis, they search online for help. By having a strong online presence, you intercept the customer directly, control the relationship, and keep 100% of the profit.

150 E 10th St

Bloomsburg, PA 17815

(570) 634-5885

justin@realtimeleadgen.com

Justin Hess, Founder & Google Alchemist