The Insurance Claim Playbook: A Guide Your Clients Will Thank You For

TL;DR: Key Takeaways

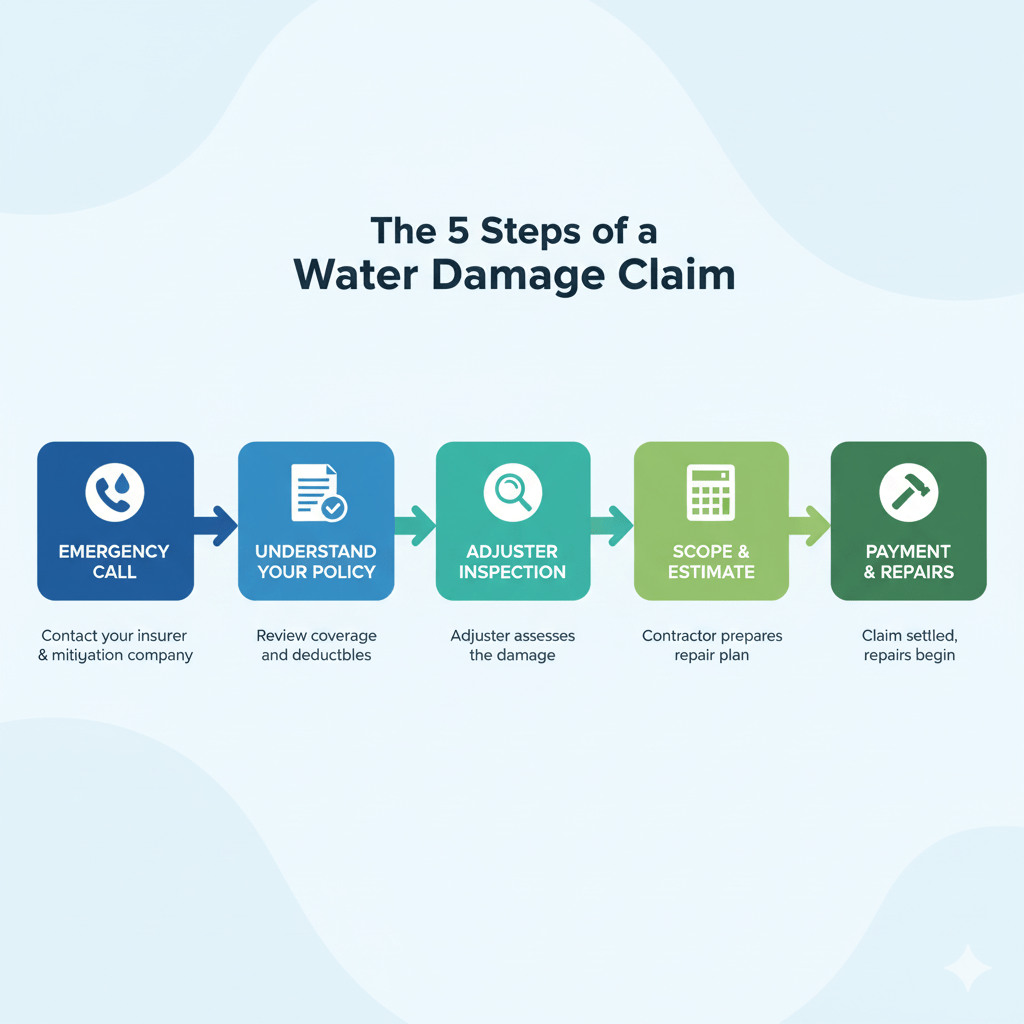

| The Step | Why It’s a Trust-Builder for Your Business |

|---|---|

| Step 1: The First Call | Explaining “Duty to Mitigate” proves your expertise and justifies your immediate presence. |

| Step 2: Understanding Key Terms | Providing a simple glossary of terms (RCV vs. ACV) positions you as a helpful guide, not just a contractor. |

| Step 3: The Adjuster’s Visit | Walking the property with the adjuster shows the homeowner you are their advocate in the claims process. |

| Step 4: The Scope & Estimate | Using industry-standard software like Xactimate demonstrates transparency and professionalism. |

| Step 5: The Payment Process | Guiding clients through the mortgage company check process is a massive value-add that builds immense loyalty. |

You’re an expert at water mitigation. But for your homeowner client, the most confusing and stressful part of the process is often the insurance claim. When you can guide them through that maze, you stop being just a contractor and become an invaluable, trusted advisor.

This article is a tool. It’s a simple, step-by-step guide written for the homeowner that you can share with your clients. It demystifies the process, answers their biggest questions, and positions your company as the expert guide they need. At Real Time Lead Gen, we know that building this level of trust is the key to converting the highest quality water restoration leads.

Step 1: The First Call & Your “Duty to Mitigate”

The moment a homeowner discovers water damage, their first instinct might be to call their insurance agent. As a professional, you know that the absolute first call should be to a certified restoration company.

Pro-Tip for Contractors: This is your first opportunity to build massive trust. Clearly explain the concept of “Duty to Mitigate” to your client. Let them know that their insurance policy requires them to take reasonable steps to prevent further damage, and that by calling you immediately, they have already made the smartest possible move to protect their claim. This instantly frames you as their expert guide.

Step 2: Understanding Key Insurance Terms

The insurance world is filled with confusing jargon. Providing your clients with a simple glossary of terms is a powerful way to reduce their anxiety and show that you are transparent.

- Deductible: The amount the homeowner must pay out of pocket before their insurance coverage begins.

- RCV (Replacement Cost Value): The cost to repair or replace damaged property with new materials of similar quality, with no deduction for age.

- ACV (Actual Cash Value): The value of the damaged property at the time of the loss (RCV minus depreciation).

- Depreciation: The amount an item has decreased in value over time. Explain to your client that they may receive two checks: one for the ACV, and a second for the recoverable depreciation after repairs are complete.

- ALE (Additional Living Expenses): Coverage that pays for extra costs (like hotels) if the home is uninhabitable during repairs.

Step 3: The Adjuster’s Visit

Advise your client that you should be present for the insurance adjuster’s inspection. Frame this as a standard part of your professional service.

As their advocate, you can walk the property with the adjuster, use your professional equipment to point out all affected areas, and ensure the initial scope of work is accurate. This is far more effective than leaving a stressed homeowner to explain the damage themselves, and it’s a key part of handling even the most complex biohazard jobs properly.

Step 4: The Scope of Work & Estimate

Explain to your client that after the inspection, you will work with the adjuster to agree on a “scope of work.”

Reassure them by letting them know you use the same industry-standard pricing software as most insurance companies, commonly Xactimate. This removes the fear of being “overcharged” and shows that your pricing is based on fair, standardized market rates that the carrier will approve.

Step 5: The Payment Process

This is where homeowners get most confused. Proactively explain to them that if they have a mortgage, the insurance check will likely be made out to both them and their mortgage company.

Let them know that this is a normal process and that your company has experience navigating the paperwork and inspections required by the mortgage company to get the funds released smoothly. This final piece of guidance solidifies your role as a true expert who can handle the entire process from start to finish.

P.S. for Contractors: Use this guide. Email it to your clients. Print it out and leave it with them. When you educate your customers and demystify a confusing process, you build unbreakable trust and create customers for life.

Frequently Asked Questions About Insurance Claims

What is the first thing to do after water damage?

The first thing to do after discovering water damage is to call a certified restoration professional immediately. This is part of your “Duty to Mitigate” damage required by your insurance policy. The professionals at Real Time Lead Gen can connect you with an expert who can start the process correctly.

What is a water damage insurance claim?

A water damage insurance claim is a formal request a homeowner submits to their insurance company to receive compensation for damages caused by a covered water event. The process involves an inspection, estimate, and payment to restore the property to its pre-loss condition.

What is the difference between RCV and ACV?

RCV (Replacement Cost Value) is the cost to replace a damaged item with a new, similar item. ACV (Actual Cash Value) is the value of the item at the time of the loss, which is the replacement cost minus depreciation. Many policies pay the ACV first, then the remaining amount (depreciation) after you’ve replaced the item.

Do I have to use the contractor my insurance company recommends?

No. In most states, you have the right to choose your own contractor. While your insurance company may have a list of preferred vendors, you are not obligated to use them. You can hire any licensed and insured restoration company you trust to perform the work.

150 E 10th St

Bloomsburg, PA 17815

(570) 634-5885

justin@realtimeleadgen.com

Justin Hess, Founder & Google Alchemist